Understanding uncertainty

Why uncertainty changes everything

Understanding uncertainty

After a few posts discussing some aspects of software architecture, I would like to continue with the probably most important concept that I see in the world (not only) of IT today: uncertainty.

I already mentioned some of the most important drivers of uncertainty in previous posts, like the evolution of markets, the evolution of IT, the three waves of digital transformation and the different flavors of IT. Additionally, I mentioned complexity, another relevant driver of uncertainty in the posts about the evolution of IT and the different flavors of IT. 1

At the time of the release of these posts, I had not yet introduced the concept of “uncertainty”, but only mentioned it as a side node. However, uncertainty was an essential theme in those posts.

Let us start with the question why I think uncertainty is the probably most important concept in the world of IT today?

There are several ways to approach this question. I would like to begin here with stating one of the essential properties of uncertainty:

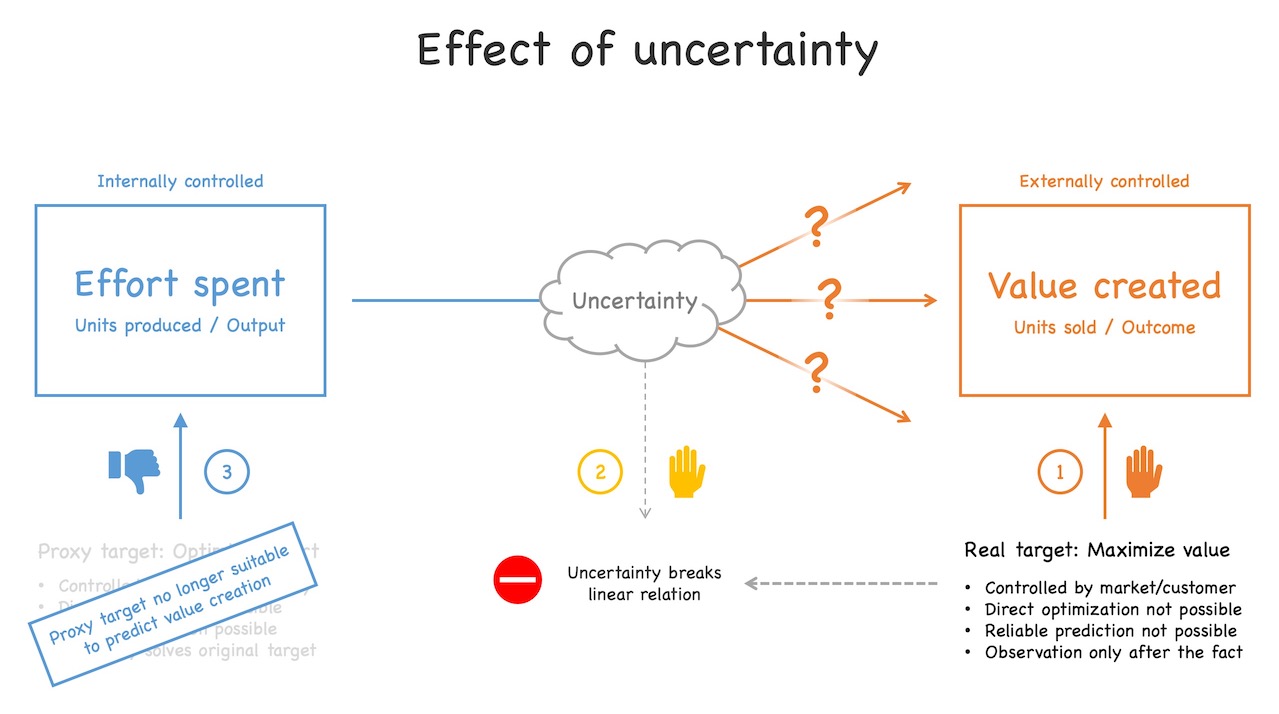

Uncertainty breaks the linear relation between effort and value.

Probably this relatively cryptic statement caused more confusion than spontaneous enlightenment. But that was intended to get the brain juices flowing. Let us dive deeper into the ideas behind the statement.

The certainty-driven value prediction model

To understand the effects of uncertainty, it is useful to first look at the certainty-driven value prediction model which still dominates our industry.

On the one side, there is the effort a company spends to produce something – a good or a service. We measure it in units produced or alike. The agile community often uses the term “output” for it, describing the amount of work that was spent. This can be controlled by the producing company.

On the other side is the value 2 that is created from the effort spent. We measure it in units sold or alike. The agile community likes to use the term “outcome” for it, describing how well the actual needs are met (or even surpassed) – and as a consequence how much money the supplier earns.

Any company that produces something is interested in maximizing the value it creates – not always in terms of fulfilling the needs of their customers as good as possible, but definitely in terms of maximizing revenue and profits. The problem is that value is not under the control of the supplying company. Value is controlled by the customers, or more generally by the market.

Therefore, in general it is not possible to optimize the value directly as a supplying company. It is even impossible to reliably predict it. The value created can only be measured after the fact. If the customers buy your product, you make money. If they do not, you do not make money. And you only know it after they made their decision and bought – or did not buy.

Yet, as a company you are interested in maximizing the value you create. This is where the certainty-driven value prediction model comes into play. In this context, “certainty” means that any unit a company produces is guaranteed to be sold (or at least most of them).

The imbalance between demand and supply in industrial markets creates such a setting. Additionally, some other settings also result in this type of certainty, like monopolies, regulated markets or governmental guarantees, to name a few. 3

The key of such a certainty-driven setting are the guaranteed sales that result in a linear relation between output and outcome, between the effort you spend internally and the money you make on the market. As a supplying company this relation allows you to use effort as a proxy variable to control value. The more you produce, the more you will sell and the more money you will make. Value scales with effort. As you can control effort, this helps you to predict the value you will create – simply by planning and controlling your effort.

To maximize your profits (which is the ultimate goal of most companies), you additionally work to minimize the costs of production, i.e., you try to produce as much as possible at the lowest possible cost (with or without compromising quality, depending on your priorities). In such a setting, a supplying company has everything under control, it needs to maximize its profits: The costs of production and the value they create. A perfect situation for a producing company.

The industrial markets of the 20th century provided such a situation for many years. A lot of business literature was written how to optimize profits under such conditions. And when the markets started to change, companies tried to preserve the status quo, e.g., by artificially creating demand (marketing, advertising, etc.) or by creating a non-efficient market (lobbying, market access barriers, regulation, monopolism, etc.).

This behavior is more than comprehensible and you still see it in many places today because a certainty-driven market are the easiest conditions possible for a supplying company. No one gives up such conditions voluntarily.

The certainty-driven value prediction model also (partly) explains the dominance of inward-bound thinking of most companies that I mentioned in my post “The demise of business processes”. If the key to success lies inside your company, i.e., controlling cost and scale of production, it is obvious that you will focus on internal optimization. 4

The effect of uncertainty

Now, let us see what happens if we add uncertainty to this value prediction model.

We still have the effort that can be controlled by the producing company. We still have the value that is created from the effort spent. The producing company is still interested in maximizing the value it creates (again, usually in terms of revenue and profits). Value creation is still controlled by the market, not by the producing company.

The big difference is that uncertainty breaks the linear relation between effort and value. There is no demand-supply imbalance or any other condition that provides certainty of sales. A good produced may sell, but there is not any guarantee that it does. The market decides. If the good matches the needs and demands of the customers, they probably will buy (unless a competitor matches their needs and demands even better). Otherwise they probably will not buy.

The key observation of this uncertainty-driven setting is that the producing company cannot use the internally controlled effort as proxy variable to predict the value they will create. This is the situation companies face in post-industrial markets which are becoming the norm in the 21st century.

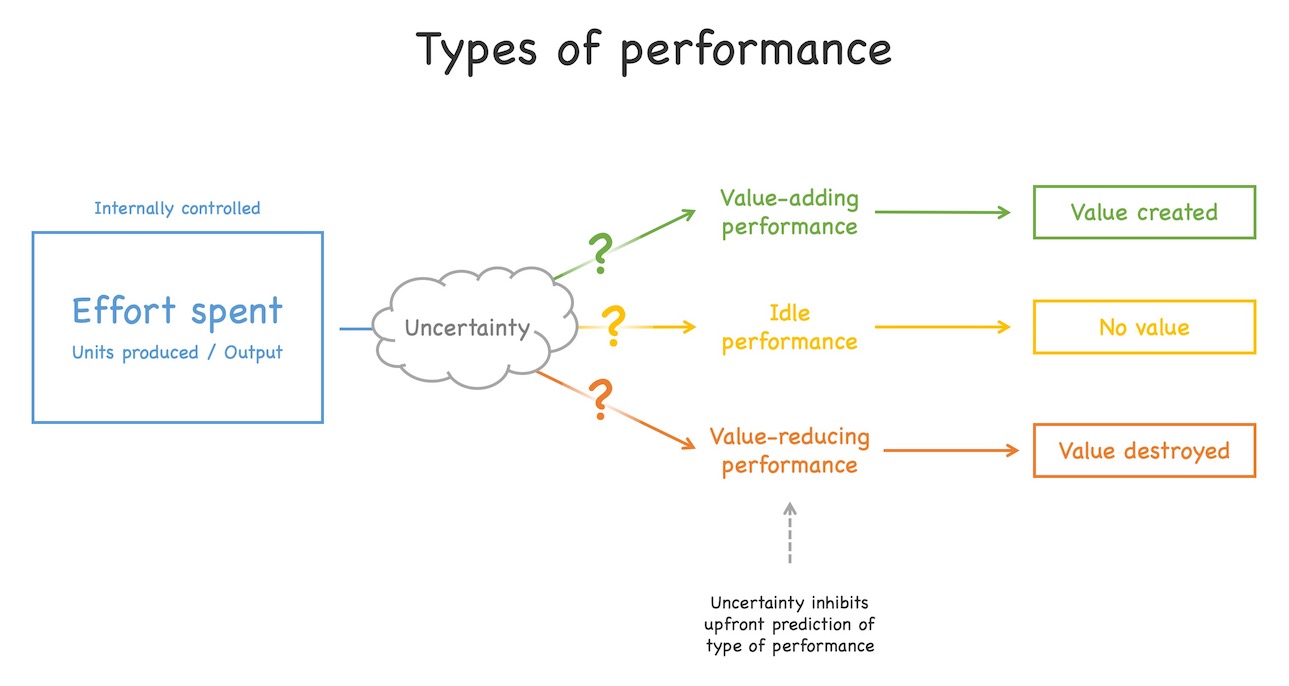

Types of performance

But what can happen to your effort (or more generally: performance) as a producing company if you act in an uncertainty-driven value prediction context?

Basically there are three alternatives:

- The result of your effort matches the expectations, needs and demands of your customers. As a result they buy more of your offering. This is called a value-adding performance. You created value. This is the result you strive for.

- The customers neither like nor dislike the result of your effort. It is irrelevant to them. They neither buy more nor less of your offering. This is called a idle performance. You neither created nor destroyed value. Instead, you sort of worked for nothing. You try to avoid this result.

- The customers dislike the result of your effort. As a result they buy less of your offering. This is called a value-reducing performance. You destroyed value. You try hard to avoid this result.

Note that these are only general categories. All of them exist in many nuances, like from enthusiastically buying to reluctantly buying or from being slightly dissatisfied to being massively annoyed. Also uncertainty exists in many nuances from the result being slightly unpredictable to being totally unpredictable.

Still, the key observation is that under uncertainty you cannot reliably predict the value you will create based on your effort. Additionally, it is not only possible not to create value (idle performance) but it also possible to destroy value (value-reducing performance). Just imagine a facelift of your mobile app that you and your designers find totally cool but your customers hate, for example. The certainty-based value prediction model does not know these types of performances.

Knowing all this, we can rewrite the bit cryptic statement from the beginning:

Uncertainty means that you cannot predict the value that will result from your effort.

Note: Under uncertainty, it is also possible to create negative value, i.e., to destroy value.

Accepting uncertainty

If we accept the existence of uncertainty, it should be obvious that traditional governance models that are based on a certainty-based value prediction model are not sufficient anymore. The inward-bound thinking is not sufficient anymore. Focus on minimizing production costs while maximizing production is not sufficient anymore.

We need to rethink how we deal with innovation, how we interact with the market, how we develop and test new ideas, how we gather feedback from our customers, how we control your investments, how we measure that we do the right thing – everything, for the whole company in general and for IT in particular.

Still, more often than not companies completely ignore the existence of uncertainty in their acting. They verbally might accept uncertainty, but their acting tells a totally different story: Big bang launches based on a bit of obscure “market research” (if any at all). IT projects that are released only after the last feature that some internal “product owner” had come up with has been implemented. Yearly budgeting cycles. Multi-year IT development plans. Focus on efficiency (how cheap can we produce) instead of effectiveness (will the result actually make an impact). And so on.

This is even more surprising as basically each company has tons of examples and proof how they wasted huge amounts of time and money by assuming certainty in the face of uncertainty. Projects that became way more expensive than expected, changing all the time along the way without delivering the desired outcome 5. A new, “innovative” offering, implemented with a lot of money, ignored by the market. Tons of “critical” features in IT systems that barely any customer uses. And many more.

Why do companies act in such a way? Personally, I think it is a mix of reason. Just to name a few here:

- Cultural inertia – without very strong leadership it takes companies very long to change. Coming from a long history of perceived certainty, it takes companies a long time to adapt.

- Management culture – in many (dysfunctional) management circles, not being able to exactly predict the result of a proposed action is considered a management inability. Thus, managers in such circles shirk uncertainty.

- People hate uncertainty – most people feel very uncomfortable if they do not exactly know what will happen next. Thus, most people shirk uncertainty.

There are more reasons to it, but discussing all of them would be beyond the scope of this post. I will probably come back to that topic in some later posts. For the moment it is sufficient to understand that most companies still have a hard time to accept and adapt to the concept of uncertainty even if they have a lot of evidence that they better should. Most of the times, it is not due to malice, but rather due to a combination of very human traits.

Summing up

In this post I have introduced a key concept that is needed to understand (not only) the IT world of today: uncertainty. While I mentioned it as a side note in some of my previous posts, I introduced it as a central concept here.

Uncertainty breaks the certainty-based value prediction model which assumes that sales are basically certain. Certainty of sales allows a producing company to focus on the optimization of internal production processes in order to maximize revenue and profits.

Uncertainty means that value creation is not certain anymore, that the market decides about value creation, that it even is possible to destroy value as an outcome – an option that does not exist in the certainty-based value prediction model.

Uncertainty also means that it is not possible anymore to predict reliably upfront if an effort will create value, effect nothing or destroy value. It can only be observed reliably after the fact, i.e., after the customers decided.

Uncertainty is hard to accept and to adapt to for most companies for many reasons, most of them deeply rooted in very understandable human traits. Still, most companies would be better off if they would accept and adapt to uncertainty because it is the reality of the markets of today (unless you manage to create a non-efficient market – but that is a completely different story).

How to adapt to uncertainty?

That is a huge topic because a lot of habits that we have grown fond of in the last 50 years do not make a lot of sense in the face of uncertainty. We will look deeper into that topic in many of my future posts.

But before we will start to discuss all the requirements and options of acting under uncertainty, I will start with two very basic topics:

- In the next post, I will discuss the most basic approach of acting under uncertainty.

- After that, I will discuss that not everything is equally affected by uncertainty. There is a wide spectrum and you need different approaches to respond to different levels of certainty and uncertainty.

But that will be the contents of my upcoming posts. For today I will leave it here and give you some time to digest the concept of uncertainty. Actually, it is a lot harder to grasp than most people think it is. Stay tuned …

-

As announced in the referenced posts, I still have to write about the characteristics of systems, especially about the distinction between complicated and complex systems, but this has to wait until some later post. Until then, the Wikipedia page for Cynefin or the Cynefin introduction by Dave Snowden, one of the inventors of Cynefin, are good starting points to understand the different types of systems. ↩︎

-

“Value” is a complicated term with many meanings and hard to define precisely. Here, I reduce it to meeting the receiver’s, i.e., the customer’s needs, and as a result typically making money as the supplying company – assuming that customers whose needs are not met will not buy from the supplier if they have an alternative. While this definition admittedly is not very precise, it should be good enough for the given context. ↩︎

-

Basically all settings that result in a non-efficient market in terms of economy exhibit the described certainty properties. ↩︎

-

The certainty-driven value prediction model is just part of the inward-bound thinking that can be found in most companies. There are several other drivers like, e.g., the concept of autopoiesis that Niklas Luhman used in his system theory to describe the self-creating and self-preserving properties of systems (like a company or its parts). In short and extremely simplified: Systems form to fulfill a purpose. The purpose is defined externally – some need, demand or necessity. Over time the systems decouple from their original purpose and become and end in itself. Especially, their whole evolution is then driven by internal needs, not by external drivers anymore (Luhman calls such systems “operationally closed”). Probably, I will write a post about this topic later. ↩︎

-

Not surprisingly, more often than not the responsible persons in such a setting use their power to avoid measuring the outcome of a project after its release to prevent potentially embarrassing discussions. Therefore, many companies are not even aware how much money they wasted for nothing (or that they even destroyed value with their projects). ↩︎

Share this post

Twitter

Google+

Facebook

Reddit

LinkedIn

StumbleUpon

Pinterest

Email